CFPB, NY AG Sue Auto Lender For Predatory Practices, Aggressive Collection Efforts

Account Recovery

JANUARY 5, 2023

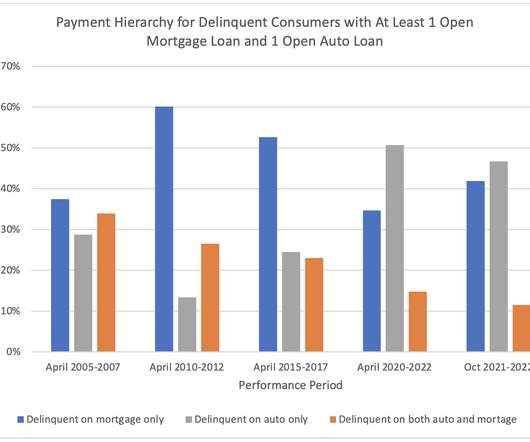

The Consumer Financial Protection Bureau and the Attorney General of New York yesterday filed a lawsuit against an auto lender, accusing it of tricking consumers into high-cost loans on used cars that resulted in unaffordable monthly payments, vehicles being repossessed, and customers facing debt collection lawsuits.

Let's personalize your content