What True Low-Interest Credit Cards Are Available?

Nerd Wallet

MARCH 4, 2021

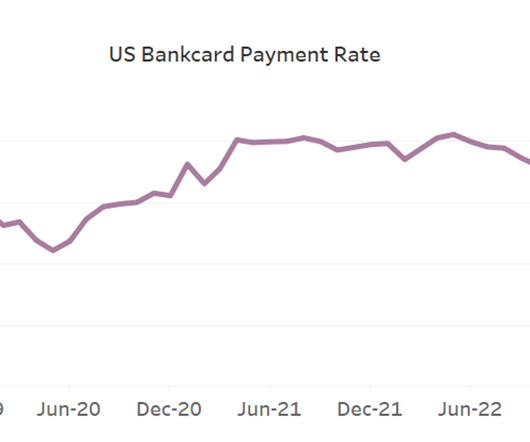

A credit card’s APR is irrelevant if you don’t carry a balance from month to month because you won’t be charged any interest. As of November 2020, the average annual percentage rate for cards that accrued interest was 16.28%, according to. The article What True Low-Interest Credit Cards Are Available?

Let's personalize your content