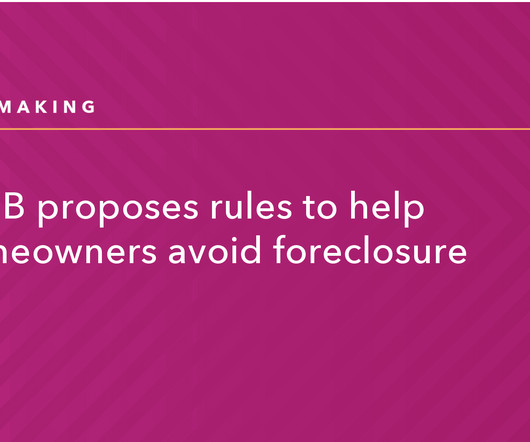

CFPB Proposes Rule to Help Homeowners Facing Foreclosure

Account Recovery

JULY 11, 2024

These proposed rules focus on reducing the bureaucratic burden on both borrowers and servicers, aiming to prevent unnecessary foreclosures and improve communication. The Consumer Financial Protection Bureau has proposed new regulations to simplify and expedite the process for homeowners seeking mortgage assistance.

Let's personalize your content