Getting to Know Debbie Frank of Credit Bureau Services

Account Recovery

MAY 5, 2022

… The post Getting to Know Debbie Frank of Credit Bureau Services appeared first on AccountsRecovery.net.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Credit Bureau Related Topics

Credit Bureau Related Topics

Account Recovery

MAY 5, 2022

… The post Getting to Know Debbie Frank of Credit Bureau Services appeared first on AccountsRecovery.net.

Account Recovery

MAY 5, 2022

GETTING TO KNOW DEBBIE FRANK OF CREDIT BUREAU SERVICES One of the great benefits of working in the accounts receivable management industry is the willingness to collaborate, the understanding that a rising tide lifts all boats. Perhaps nobody appreciates that — and embodies it — more than Debbie Frank.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Account Recovery

JUNE 10, 2021

… The post Getting to Know Diann Jenkins of Credit Bureau of Jonesboro appeared first on AccountsRecovery.net.

Account Recovery

APRIL 28, 2023

The chief executives of the three major credit reporting agencies yesterday testified before the Senate Banking Committee that they would exclude all medical debts from consumers’ credit reports if they were ordered to do so by the Consumer Financial Protection Bureau, but only if they were ordered to do so.

Account Recovery

OCTOBER 19, 2023

Getting to Know Laura Thesing of Credit Bureau Data Judge Grants Defense’s MSJ in FDCPA Case Over DOFD Student Loan Repayments to Have Little Impact on Economy: Fed Report Collection ‘Kingpin’ Accused of Destroying Evidence WORTH NOTING: If you haven’t figured out what to be for Halloween yet, here is someone who can help you […]

Account Recovery

JANUARY 12, 2024

In response to a new law enacted last month in New York, one of the three major credit reporting agencies has announced it will no longer include any medical debt for residents of the Empire State on their credit reports. The move affects 2.2% of the total amount of medical debt, according to the company. […]

Account Recovery

JUNE 10, 2021

GETTING TO KNOW DIANN JENKINS OF CREDIT BUREAU OF JONESBORO There is no doubt that new ways of doing business are revolutionizing the accounts receivable management industry. Getting to Know Diann Jenkins of Credit Bureau of Jonesboro; Ninth Circuit Reverses Ruling in FDCPA Case appeared first on AccountsRecovery.net.

Nerd Wallet

FEBRUARY 10, 2022

There are plenty of reasons why you might need to contact one of them, including disputing an item on your credit report, freezing your credit, or reporting fraud or identity theft. While the major credit bureau websites offer the ability to do. Amanda Barroso writes for NerdWallet. Email: abarroso@nerdwallet.com.

Fico Collections

SEPTEMBER 15, 2022

Saudi Credit Bureau Delivers Access To Loans For Millions with Score. Read this blog on financial inclusion and the social good that can come from credit scores. SIMAH wins FICO ® Decisions Award for financial inclusion using FICO ® Scores. Saxon Shirley. Fri, 09/09/2022 - 03:42. by Nikhil Behl. expand_less Back To Top.

Account Recovery

APRIL 22, 2024

CDA) and The Credit Bureau of Columbia/Account Management Services (AMS). Ann, Mo — April 22 — Consumer Adjustment Company, Inc. CACi) is excited to announce the acquisitions of Creditors’ Discount & Audit Co. The two companies are the latest to join the CACi family and further demonstrate the company’s stability and rapid growth.

Credit Corp

NOVEMBER 9, 2020

Can a collection agency report to a credit bureau without notifying you? ExtraCredit is offering an exclusive discount to one of the leaders in credit repair, so sign up today. The post Can a Collection Agency Report to the Credit Bureau Without Notifying You? The answer might not be that simple.

Account Recovery

JANUARY 12, 2024

Collector Facing FDCPA Class Action for Allegedly Not Accepting Insurance Information from Plaintiff Judge Dismisses FDCPA Suit Over Failure to Respond to Disputes CFPB Issues Advisory Opinions on FCRA Procedures Credit Bureau Removing All N.Y.

Account Recovery

MARCH 12, 2021

Attorneys general from 41 states have reached a settlement with Retrieval-Masters Credit Bureau, which operated a collection agency under the name of American Medical Collection Agency, stemming from a data breach in 2019 that exposed the personal information of more than 7 million individuals.

Account Recovery

JUNE 29, 2021

What Credit Karma says in its reports about a consumer’s credit history is not gospel, a District Court judge in Tennessee has ruled, granting a defendant’s motion for summary judgment after it was accused of violating the Fair Debt Collection Practices Act because it allegedly communicated information to a credit bureau after it was instructed (..)

Nexa Collect

FEBRUARY 15, 2023

Open-ended contract with no minimums and free credit bureau reporting. Contact us if you need a collection agency with the following features. No setup fee and no hidden charges. We guarantee it. High collection rates and an easy-to-use online client portal. Offers both Fixed-fee service and Contingency-only based collection services.

Fico Collections

AUGUST 23, 2021

For most of the credit-eligible US population there is sufficient traditional credit bureau data available for calculating a FICO® Score. An independent study conducted by the CFPB reached very consistent conclusions to our own, sizing the ‘credit invisible’ population at 26 million consumers.

Nexa Collect

JUNE 4, 2022

Credit Bureau Reporting changes: Starting July 2022, the top 3 credit bureau agencies made it harder to report medical debts for credit reporting. CFPB rules: On November 30, 2021, the CFPB’s new Debt Collection Rules became effective, becoming a major roadblock for the entire Collections industry.

Fico Collections

SEPTEMBER 24, 2021

For example, in the US, 92 percent of consumers have cell phones, but just 5 percent of consumers have telco data reported in their traditional credit bureau files. Figure 1: Credit bureau coverage is greater for some types of data than others. FICO has a solution to this problem. market. .

Fico Collections

JUNE 2, 2023

consumer data not present in the traditional credit bureau files) to enhance the predictiveness and inclusiveness in credit scoring. with little or no credit information in their traditional credit bureau files, who have traditionally struggled to access credit. More than 200 million U.S.

Credit Corp

MAY 3, 2023

If you’ve got an error of your credit report, it’s up to you to find it, dispute it, and fix the error. Formally disputing an error involves writing a formal dispute letter to the creditor as well as the appropriate credit bureau reporting the inaccuracy. Tell the credit bureau what action you want them to take.

Credit Corp

NOVEMBER 30, 2023

It’s a simple approval process, and with at least 6 months of responsible behavior you can be considered for a credit line increase. Learn how to apply for a Capital One Platinum credit card! With no annual fees, guaranteed credit bureau reporting and periodic credit reviews, this card can help improve your credit.

Troutman Sanders

APRIL 7, 2022

Plaintiffs Theresa Tailford, Sanford Buckles, and Jeffrey Ruderman sued a national credit bureau for FCRA violations, alleging failure to disclose certain information in the file disclosures the credit bureau provided upon request.

Nerd Wallet

MARCH 30, 2022

A top-tier business credit score can unlock preferred rates on financing and business insurance, and it can also open the door to potential partnerships and trade credit arrangements. The article How to Check Your Business Credit Score originally appeared on NerdWallet. Kelsey Sheehy writes for NerdWallet.

Fico Collections

FEBRUARY 10, 2022

Developed by FICO in partnership with LexisNexis Risk Solutions and Equifax, this innovative score utilizes alternative data—data not included in the traditional credit bureau file. The inclusion of this alternative data leads to a more reliable estimate of consumer credit risk and helps score more than 26.5

Fico Collections

OCTOBER 24, 2022

FICO® Score 10 T incorporates trended credit bureau data. Different than traditional credit bureau data, the use of trended data considers a historical view of data such as account balances for the previous 24+ months, giving lenders more insight into how individuals are managing their credit. .

Fico Collections

SEPTEMBER 24, 2021

For example, in the US, 92 percent of consumers have cell phones, but just 5 percent of consumers have telco data reported in their traditional credit bureau files. Figure 1: Credit bureau coverage is greater for some types of data than others. FICO has a solution to this problem. market. .

Troutman Sanders

JULY 12, 2023

Providing inaccurate information to a credit bureau. Failing to report both the favorable and unfavorable payment history of the borrower to a national consumer credit bureau at least annually if the student loan servicer regularly reports such information. Misapplying student loan payments to the outstanding balance.

Nerd Wallet

OCTOBER 13, 2021

Personal loans accounted for $148 billion in consumer debt in the fourth quarter of 2020, a decline from the same period in 2019, according to credit bureau TransUnion. Personal loans are usually unsecured, meaning they don’t require collateral like a house or a car, and you can use them for almost anything. Lenders rely on.

Sawin & Shea

FEBRUARY 14, 2023

So, it is usually the creditors or the credit bureau themselves that access this information and report it. The Bankruptcy Court has no control over what credit bureaus do with the information once they access it. You can file your dispute with the credit bureau by phone, by mail, or by using their online system.

Nexa Collect

JANUARY 14, 2023

Not just the government, but even credit bureaus are creating roadblocks for hospitals, doctors and dentists, who rely on collection agencies and credit bureau reporting for medical debt recovery.

Fico Collections

NOVEMBER 10, 2021

In fact, while other credit scoring models may generate a credit score based on stale credit information , our minimum scoring criteria requires that at least one credit account has updated information reported in the last six months. How frequently the data is updated depends on where it resides: Credit Bureau Data.

Nerd Wallet

AUGUST 18, 2020

Whether it’s to earn rewards toward vacations or just finance everyday purchases, there’s strong demand for credit cards among older adults. According to a report from credit bureau Experian, baby boomers (those born between 1946 and 1964) carried an average of 4.8 Erin Hurd is a writer at NerdWallet.

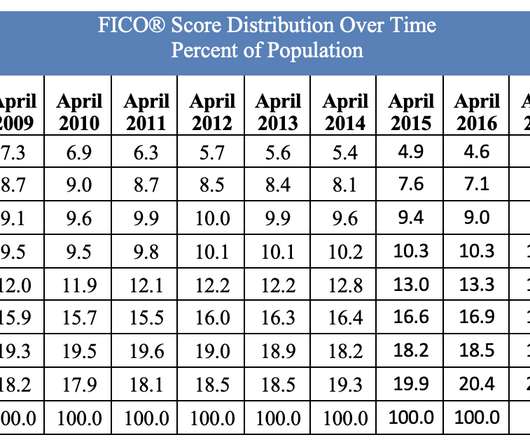

Fico Collections

AUGUST 29, 2022

and globally -- making access to credit more efficient and objective, which has continued into the present day. FICO® Scores are dynamic and evolve as changes in consumer behavior are reflected in the underlying credit bureau data housed and managed by the three primary U.S. consumer reporting agencies (CRAs). in April 2022.

Troutman Sanders

JUNE 3, 2022

Please join Troutman Pepper Partner Dave Gettings and his guest Eric Ellman of the Consumer Data Industry Association (CDIA) for a conversation on recent industry developments in credit reporting. Dave and Eric discuss the CDIA’s mission, the idea of a government-run credit bureau, and recent trends in FCRA litigation.

Titan Consulting

MAY 3, 2020

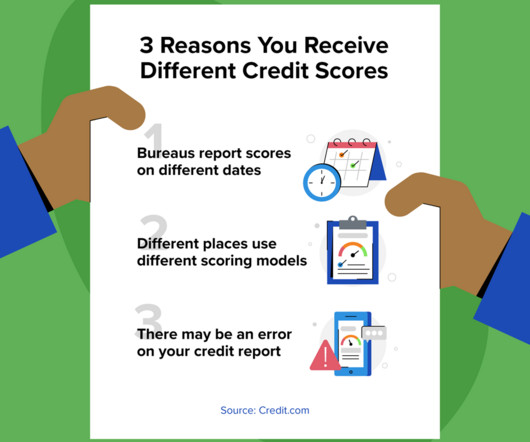

Due to the fact that not all companies report to all three credit bureaus, there are often differences in the information retained by each credit bureau. Credit scoring companies like FICO rely primarily on the information contained in the credit report, which can result in a different credit score for each credit bureau.

Nexa Collect

APRIL 27, 2022

Shouldn’t all unpaid debts ( medical or otherwise), be reported to credit reports in the same way? Forcefully suppressing unpaid medical debts from credit bureau reporting will certainly result in many unintended consequences. Then let the lenders decide which one they want to consider or ignore.

Fico Collections

APRIL 12, 2023

And while some of our clients’ business lines benefit from the very latest innovations, others such as mortgage continue to find that older versions of the FICO® Score – even some that were first developed decades ago – meet their needs for credit risk assessment. We also recognize that our scores serve many different purposes.

Fico Collections

DECEMBER 4, 2020

To further enhance flexibility and predictive power, the addition of FICO® Score 10 T incorporates trended credit bureau data. With the FICO® Score 10 Suite, lenders gain up to a ten percent predictive lift over previous FICO Score models.

Fico Collections

AUGUST 16, 2021

There are 53 million consumers who don’t have sufficient data in the traditional credit bureau files to generate a credit score today. that show a personal financial history that isn’t captured by the credit bureaus. . that show a personal financial history that isn’t captured by the credit bureaus.

Fico Collections

APRIL 28, 2022

To the extent that BNPL loans are reported to the CRAs and incorporated into the core consumer credit bureau file, they will be factored into all existing versions of the FICO Score. But what might be the impact to the FICO ® Score of BNPL accounts being included in the credit report?

Credit Corp

JUNE 1, 2023

Which Credit Bureau Is Most Accurate? In addition to the two primary scoring models, you will also find different scores with each credit bureaus. With Experian being the largest credit bureau , many people wonder how accurate the Experian credit score is.

BYL Collections

OCTOBER 6, 2017

One of the questions most asked of BYL Collections during onboarding of new accounts is regarding credit bureau reporting. Obviously, our credit and collections clients understand how credit bureau reporting may actually prompt a call or payment from a customer.

Credit Corp

OCTOBER 25, 2023

We’ll explore the nuances of both situations and share ways you can bolster your credit. Key Takeaways Everyone starts with no credit until we take an action that must be reported to a credit bureau. It takes time to increase your credit, whether you have bad or no credit. What Are the Impacts of Each?

Credit Corp

JANUARY 21, 2021

Yes, you might be able to sue a company for false credit reporting. Begin by challenging the information with the credit bureau. False information hits credit reports for a variety of reasons, including misunderstandings and honest mistakes such as clerical errors.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content