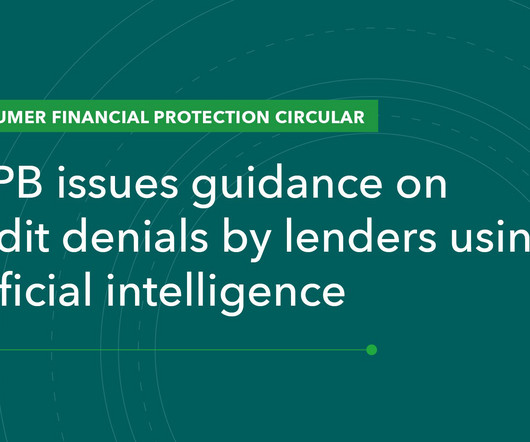

CFPB Sues Payday Lender for Hiding Repayment Options

Account Recovery

JULY 13, 2022

The Consumer Financial Protection Bureau yesterday filed a lawsuit against Populus Financial Group, which does business as ACE Cash Express, accusing the payday lender of hiding fee repayment plans from borrowers, allegedly inducing those consumers to pay $240 million in reborrowing fees.

Let's personalize your content