Boost Collections by Training Debt Recovery Skills

Enterprise Recovery

OCTOBER 4, 2024

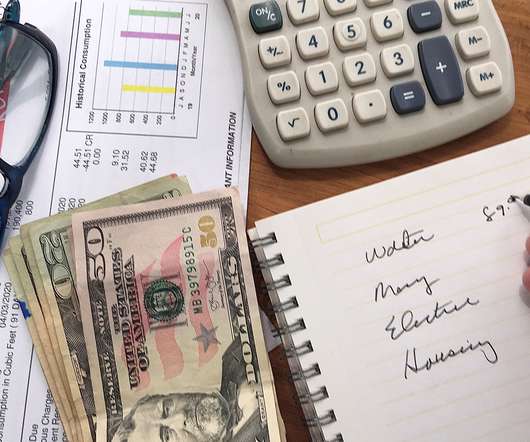

Effective debt recovery is a cornerstone of financial management. Without an efficient approach to collecting outstanding debts, businesses can suffer from cash flow issues, leading to operational challenges and potential financial instability.

Let's personalize your content