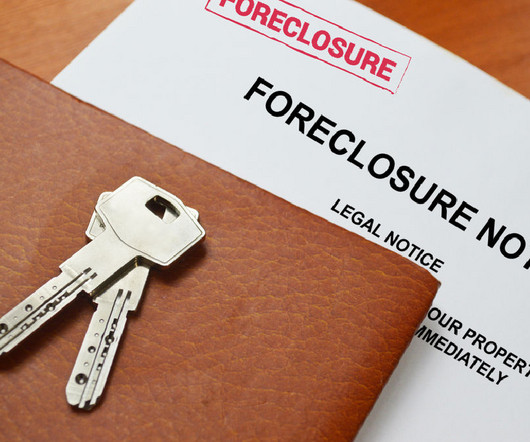

Lenders to Make More Subprime Loans in 2022, Delinquency Rates Expected to Rise: TransUnion

Account Recovery

DECEMBER 22, 2021

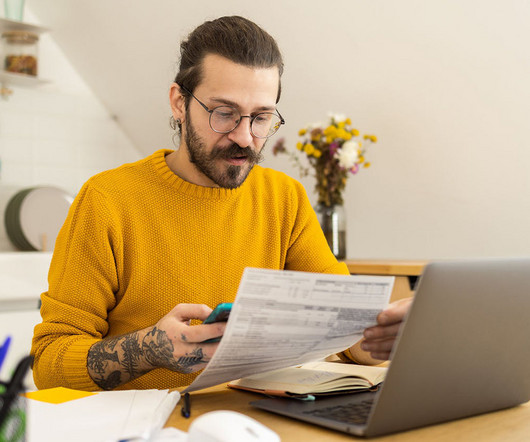

Creditors and lenders are going to be a little more aggressive in their risk-taking in 2022, according to data provided by TransUnion, thanks to delinquency and charge-off rates that have remained stable through this year.

Let's personalize your content