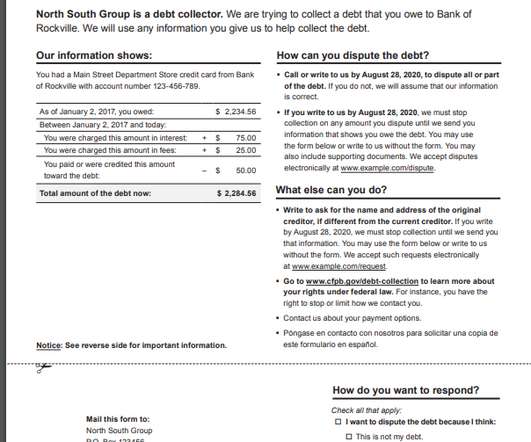

Class Action Accuses Collector of Using Inaccurate Name of Original Creditor

Account Recovery

JANUARY 13, 2023

Call … The post Class Action Accuses Collector of Using Inaccurate Name of Original Creditor first appeared on AccountsRecovery.net. The post Class Action Accuses Collector of Using Inaccurate Name of Original Creditor appeared first on AccountsRecovery.net. Want to learn more?

Let's personalize your content