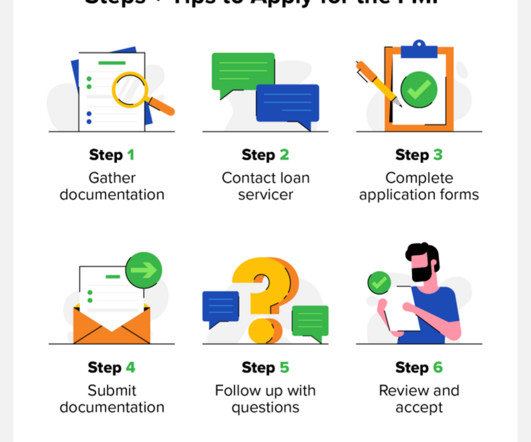

Steps Involved in Recovering Unpaid Student Loans

Nexa Collect

JUNE 27, 2023

Contact the Borrower : Reach out to the borrower to remind them of the missed payments and to discuss possible solutions. Send Formal Notices : If initial contact doesn’t resolve the issue, send formal notices outlining the amount due and the necessary steps the borrower must take to avoid further consequences.

Let's personalize your content