Consumers With More Credit Card Debt than Emergency Savings Hits All-Time High: Bankrate

Account Recovery

FEBRUARY 26, 2024

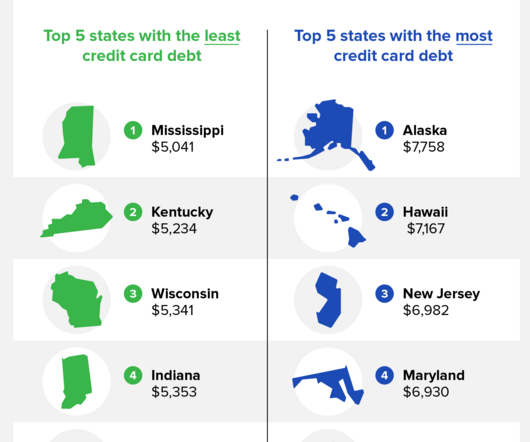

The number of consumers who are carrying more credit card debt than emergency savings has reached its highest point since Bankrate began tracking the metric 13 years ago. Another day, yet another sign that consumers are over-extended and are at risk of falling off a financial cliff.

Let's personalize your content