Oklahoma Legislature Advances Medical Debt Collection Bill

Account Recovery

FEBRUARY 27, 2024

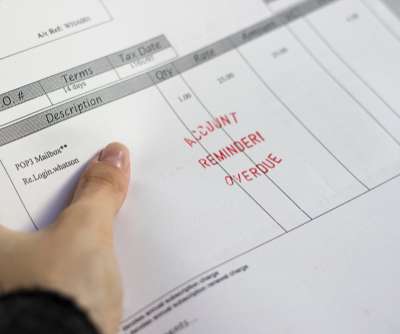

A medical debt collection bill has advanced out of committee in the Oklahoma legislature and will now head to the full state house for its consideration. The bill would require healthcare providers or third-party debt collectors to include an itemized list of the charges when filing a collection lawsuit, among other requirements.

Let's personalize your content