FICO Score 10, Most Predictive Credit Score in Canadian Market

Fico Collections

OCTOBER 28, 2022

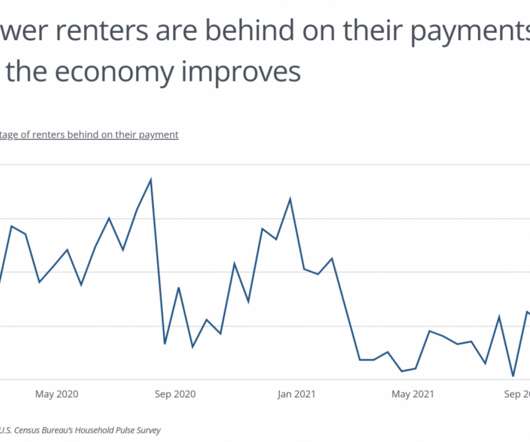

FICO Score 10, Most Predictive Credit Score in Canadian Market. Fri, 10/28/2022 - 15:00. Average FICO® Score 10. Comparing Canadian credit bureau data between April 2021 to April 2020, we saw a notable decrease in missed payments. FICO Score credit risk trends through the COVID-19 pandemic. FICO Admin. by Erik Franco.

Let's personalize your content