Debtor Protections and Consumer Rights in New York: An Attorney’s Perspective

FFGN COLLECT NY

DECEMBER 12, 2023

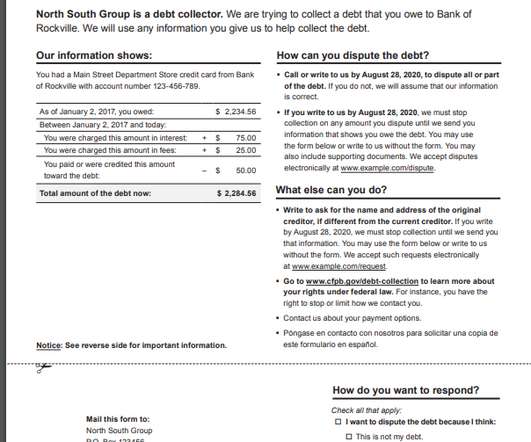

Is there a law in NYC that protects consumers and debtors from debt collecting agencies, businesses, and their attorneys? Overview of NYC Law on Debt Collection Most people might not be aware of it, but New York has some of the strictest regulations and laws regarding debt collection and debtor protection.

Let's personalize your content