Debtor Protections and Consumer Rights in New York: An Attorney’s Perspective

FFGN COLLECT NY

DECEMBER 12, 2023

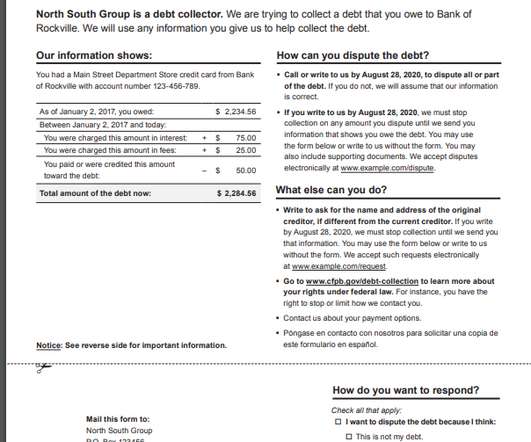

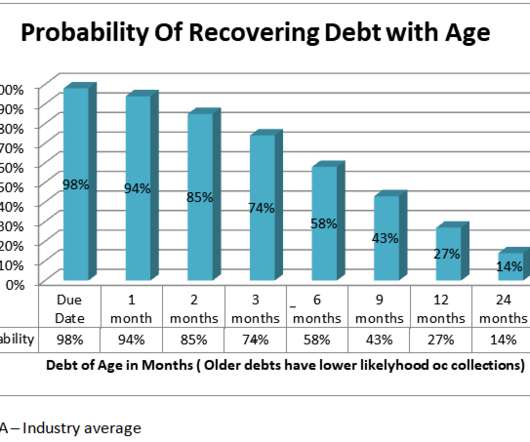

Is there a law in NYC that protects consumers and debtors from debt collecting agencies, businesses, and their attorneys? Suppose you are under constant pressure from these agencies and their legal representatives to settle your debt. Consumers must be aware that the debt they are being collected for is valid.

Let's personalize your content