How Effective Are Collection Agencies?

Nexa Collect

AUGUST 8, 2020

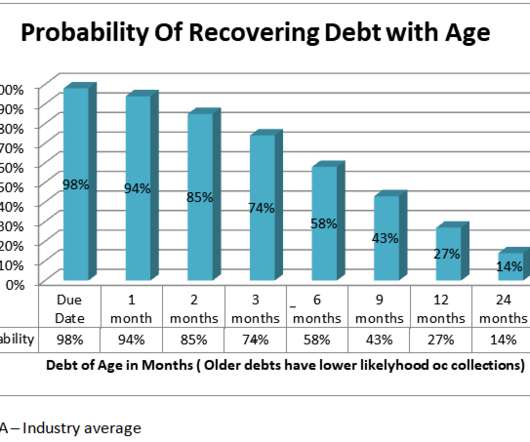

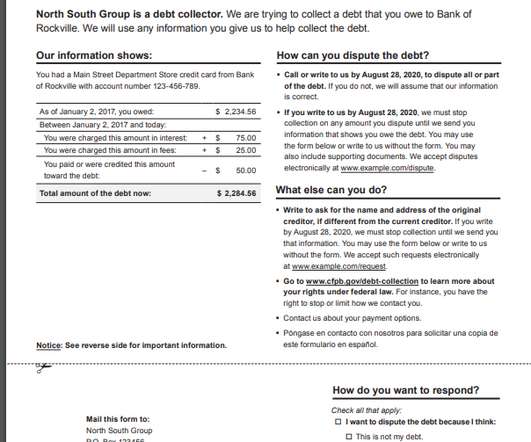

None of these situations are amenable to fast debt recovery. Companies will generally try to collect on their outstanding accounts internally before passing their most egregious cases on to an external debt collection agency. Collection agencies are experts in debt recovery. Most creditors are unaware of these.

Let's personalize your content