FICO Fact: How Alternative Data Enhances the Accuracy of Consumer Credit Profiles

Fico Collections

FEBRUARY 10, 2022

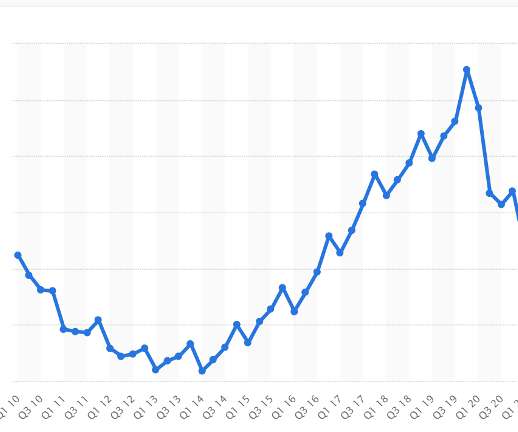

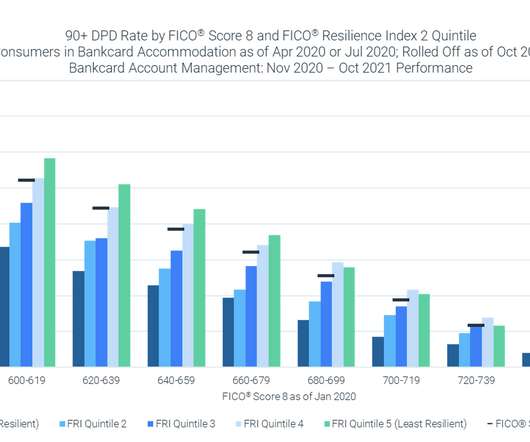

When we talk about alternative data, we focus on how it can help bring millions more people into the mainstream credit ecosystem. Developed by FICO in partnership with LexisNexis Risk Solutions and Equifax, this innovative score utilizes alternative data—data not included in the traditional credit bureau file.

Let's personalize your content