Q2 Industry Insights: Higher Monthly Expenses for Consumers, Regulatory Guidance for Financial Institutions

True Accord

JULY 13, 2023

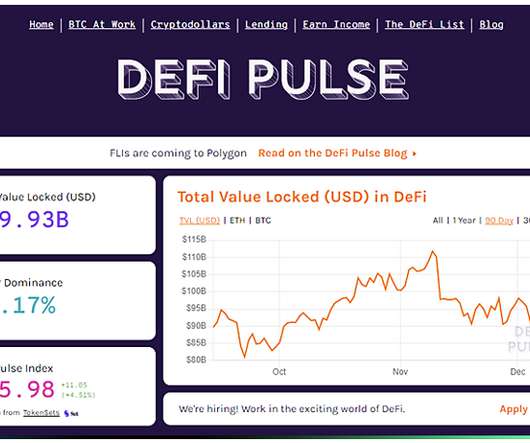

With tumult in the banking industry in Q2 and inflation and economic stressors persisting, the financial outlook for American consumers remains uncertain. The ending of various pandemic-era benefits including the pause on student loan payments will impact consumers in the coming months. What’s Impacting Consumers and the Industry?

Let's personalize your content