Credit card debt hits a ‘staggering’ $1.13 trillion. Here’s why so many Americans are under pressure

Collection Industry News

FEBRUARY 25, 2024

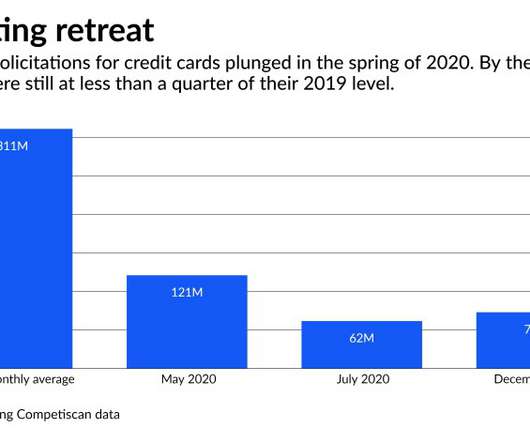

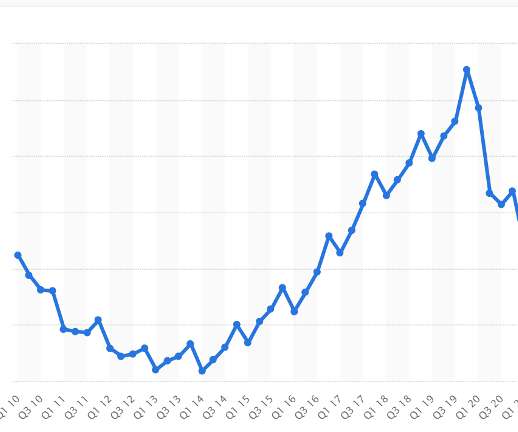

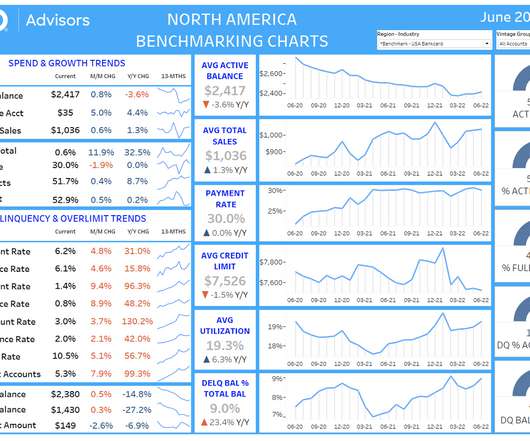

Americans now owe a collective $1.13 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York. Credit card balances increased by $50 billion, or roughly 5%, in the fourth quarter of 2023, the New York Fed found.

Let's personalize your content