How to Remove Bankruptcy from a Credit Report

Sawin & Shea

FEBRUARY 14, 2023

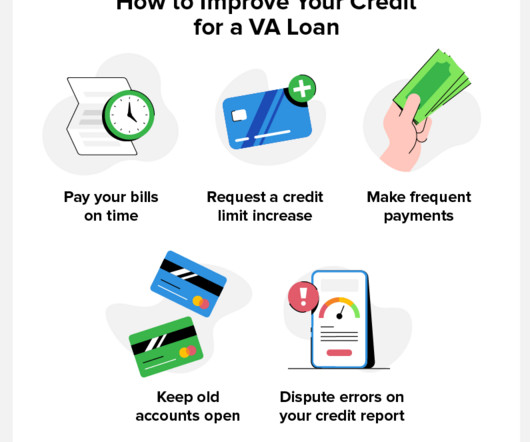

Although bankruptcy is often the only solution to get your finances back in order if you are struggling under mountains of debt, it does show up on your credit report for years, even after the bankruptcy has been discharged. You can, however, make your credit better post-filing.

Let's personalize your content