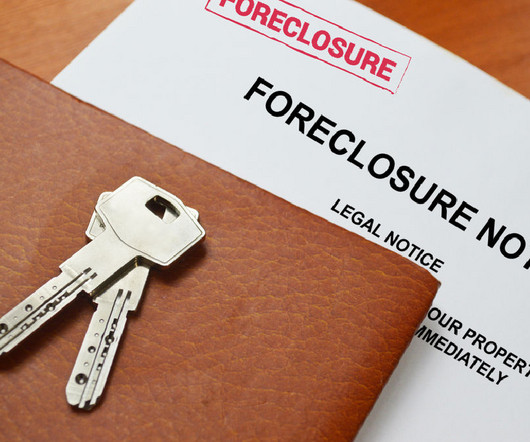

TCPA Class-Action Filed Against Lender Accused of Making Collection Calls After Consent Had Been Revoked

Account Recovery

AUGUST 10, 2021

A class-action lawsuit has been filed against Harley-Davidson Financial Services, accusing the lender of violating the Telephone Consumer Protection Act and the Illinois Consumer Fraud and Deceptive Business Practices Act because it allegedly contacted the plaintiff on her cell phone after she had revoked consent to be contacted.

Let's personalize your content