Tools to Help B2B Businesses Get Back to Work

Enterprise Recovery

MAY 8, 2020

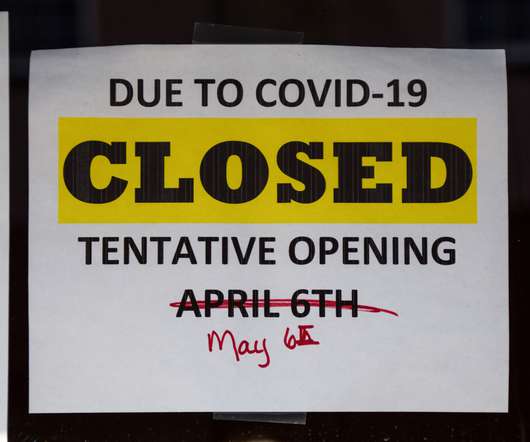

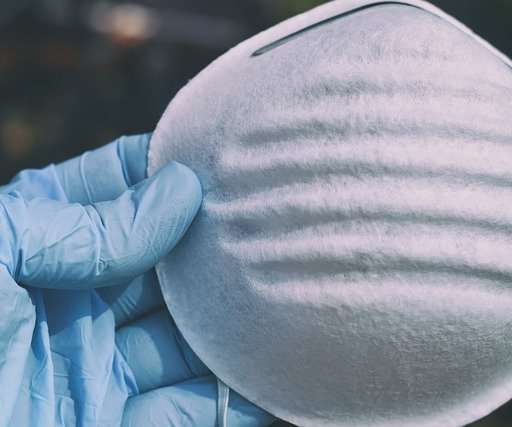

Employers and organizations are beginning to move into a new normal after the COVID-19 pandemic response affected their businesses. With lockdown orders lifted and the phased approach to reopening, business owners and executives are seeking out ways to ramp up business quickly and keep their employees safe. Many companies furloughed or laid off staff and will be running at reduced staff levels for a period of time.

Let's personalize your content