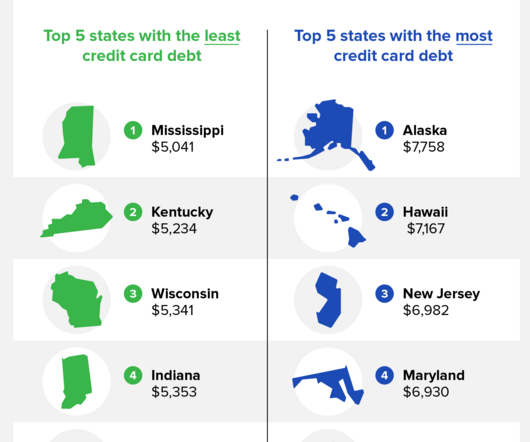

20+ Illuminating Credit Card Debt Statistics for 2023

Credit Corp

OCTOBER 6, 2023

We surveyed over 1,100 Americans to learn more about credit card debt statistics in the United States. This data covers the average debt by state, average interest rates, and more. While many of the statistics from our other sources look at the situation as a whole, our data helps us see what’s happening on an individual level.

Let's personalize your content