Impact on Credit Score due to a Medical Debt Default

Nexa Collect

JUNE 18, 2023

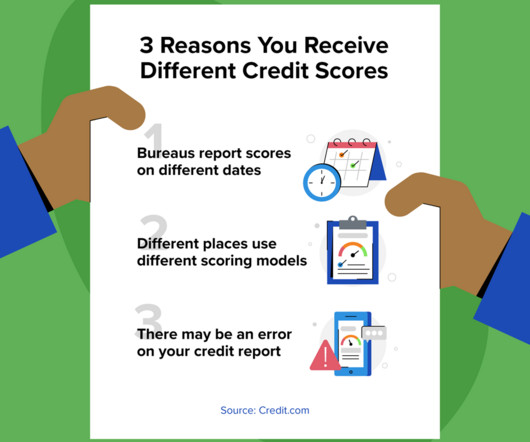

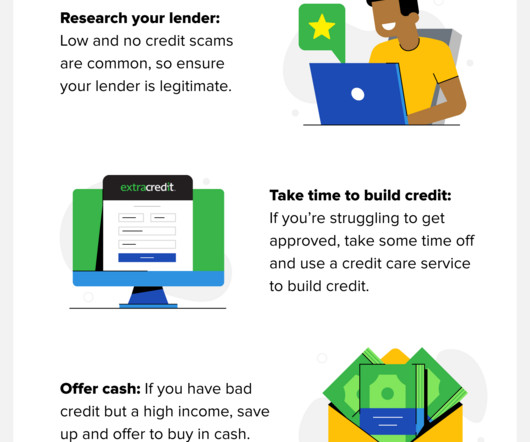

Medical debt default can significantly impact an individual’s credit score. The collection agency may then report the debt to the credit bureaus. The collection agency may then report the debt to the credit bureaus. treat medical collection accounts differently than non-medical ones.

Let's personalize your content