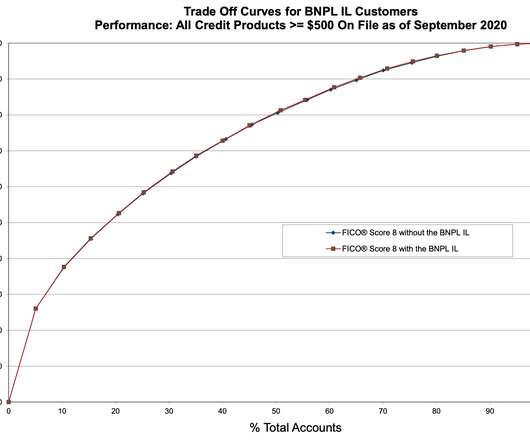

FICO Fact: How Alternative Data Enhances the Accuracy of Consumer Credit Profiles

Fico Collections

FEBRUARY 10, 2022

Developed by FICO in partnership with LexisNexis Risk Solutions and Equifax, this innovative score utilizes alternative data—data not included in the traditional credit bureau file. The inclusion of this alternative data leads to a more reliable estimate of consumer credit risk and helps score more than 26.5

Let's personalize your content