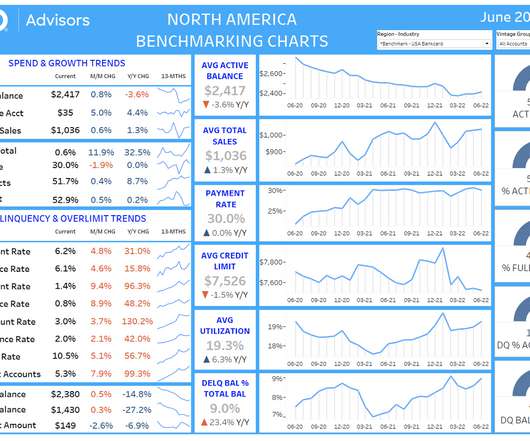

Total Household Debt Reaches $17.06 Trillion in Q2 2023; Credit Card Debt Exceeds $1 Trillion

Collection Industry News

AUGUST 17, 2023

Other balances, which include retail cards and other consumer loans, increased by $15 billion. Sections of the report are presented as interactive graphs on the New York Fed’s Household Debt and Credit Report web page and the full report is available for download. The post Total Household Debt Reaches $17.06

Let's personalize your content