Consumers Share Financial Regrets, Details about Credit Card Debt

Account Recovery

FEBRUARY 25, 2022

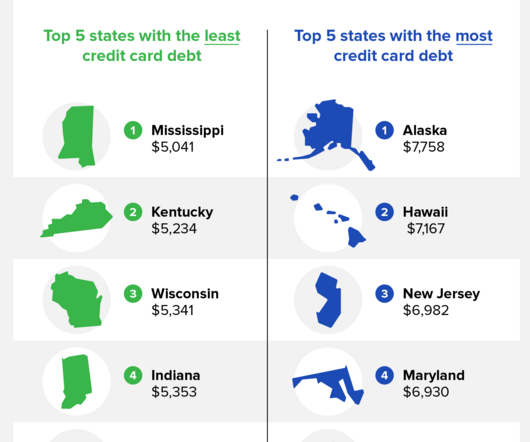

Defaulting on payments and ending up in debt collection is the fourth-most popular regret among consumers with respect to their financial situations, according to the results of a poll commissioned by TrueAccord, which it released earlier this week.

Let's personalize your content