How Large Language Models Can Revolutionize Consumer Engagement in Collections

Account Recovery

OCTOBER 11, 2024

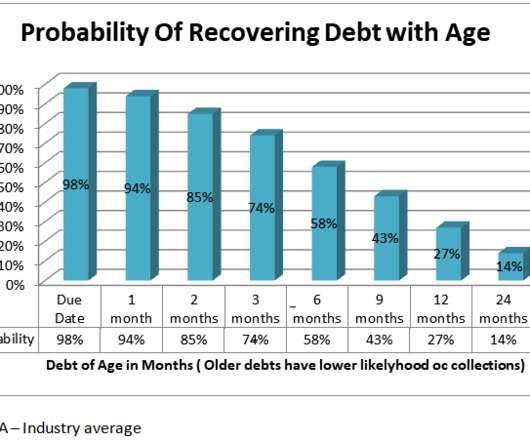

The credit and collection sector could be next. Why it matters: As collection agencies, debt buyers, fintechs, banks, and credit unions seek to improve consumer engagement, LLMs offer a potential solution for more natural and effective communication. Learn more.

Let's personalize your content