Daily Digest – April 18. Getting to Know Eddie Antoniewicz of Royal Credit Union; Judge Dismisses FDCPA Suit Over Collection Disclaimer

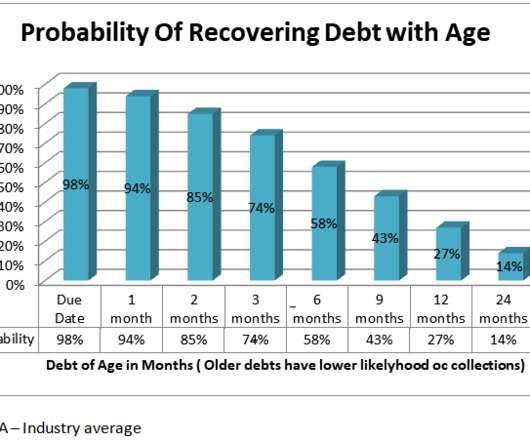

Account Recovery

APRIL 18, 2024

Getting to Know Eddie Antoniewicz of Royal Credit Union Judge Dismisses FDCPA Suit Over Collection Disclaimer Pathward Bank to Pay $700k in Fines, Penalties For Seizing Funds Paid to Debt Collectors CFPB Fines Vocational School for Deceiving Students, Hiding Finance Charges WORTH NOTING: What you eat during the day can have an impact on how […] (..)

Let's personalize your content