Q3 Industry Insights: Preparing for Credit Card Bills, Student Loans and Holiday Spending

True Accord

OCTOBER 10, 2023

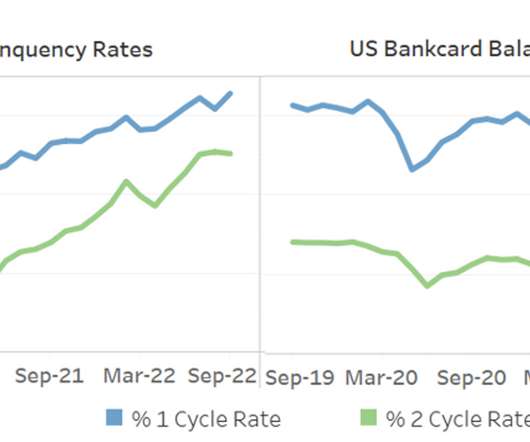

Economic stressors persist and are likely contributing to many consumers relying on credit to cover expenses, while the resumption of student loan payments adds another financial obligation to the mix. trillion in student debt under the CARES Act, student loan payments resume this month. trillion in Q2, a 4.6%

Let's personalize your content