Personal loan statistics to know for 2023

Credit Corp

MARCH 22, 2023

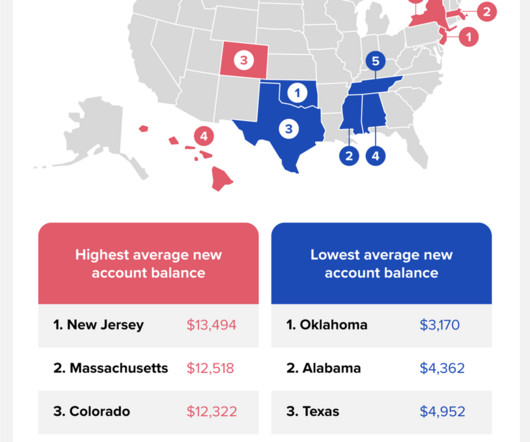

As of the second quarter in 2022, Americans owed over $192 billion in personal loans, according to TransUnion ®. If you’re one of the many Americans who took out a personal loan in early 2022, the good news is that interest rates were very low, according to the St.

Let's personalize your content