Steps Involved in Recovering Unpaid Student Loans

Nexa Collect

JUNE 27, 2023

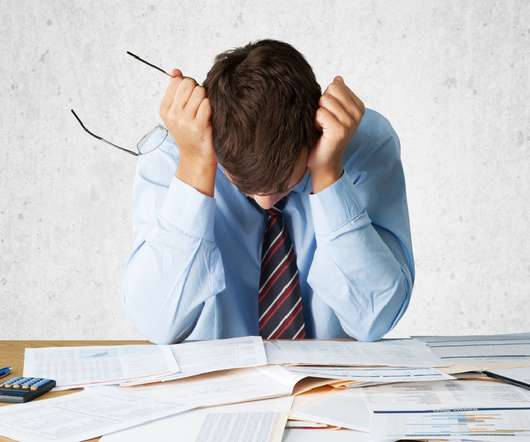

Recovering unpaid student loans is a systematic process. Just like mortgage recoveries, the steps can vary depending on the jurisdiction and the terms of the loan. Contact the Borrower : Reach out to the borrower to remind them of the missed payments and to discuss possible solutions.

Let's personalize your content