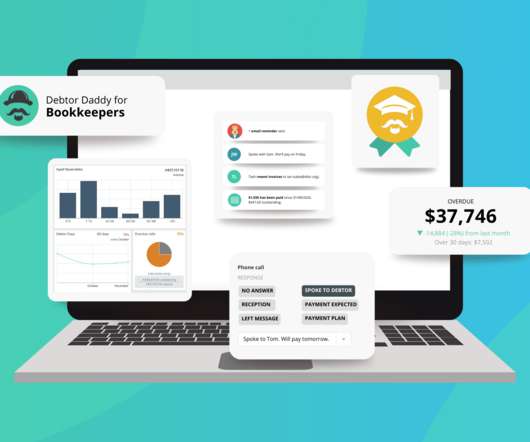

Introducing Debtor Daddy for Bookkeepers

Debtor Daddy

JUNE 20, 2021

It’s the first time we have tailored our debtor management solution to focus on a particular business market. A growing list of bookkeeping customers prompted Debtor Daddy CEO and co-founder Matt McFedries to develop ‘Debtor Daddy for Bookkeepers’. Hayley Wilson, My Two Cents.

Let's personalize your content