Daily Digest – August 2. Discount Language in Letter Leads to Class-Action; Judge Grants MSJ for Defense Over Tax Language

Account Recovery

AUGUST 2, 2022

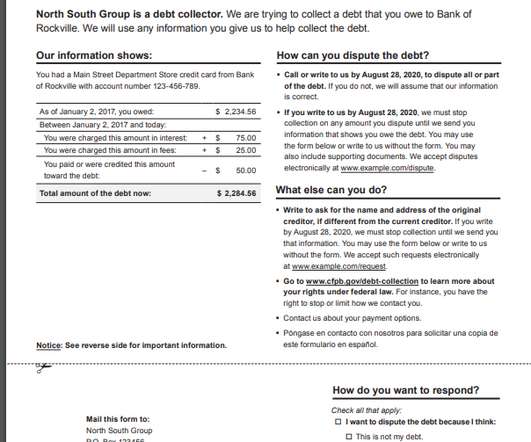

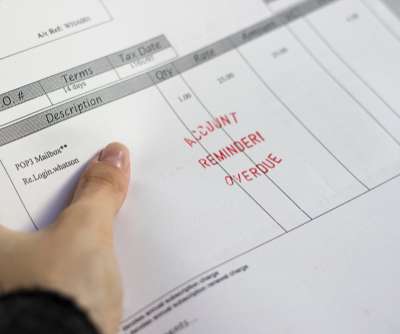

CLASS-ACTION ACCUSES COLLECTOR OF VIOLATING FDCPA THROUGH DISCOUNT LANGUAGE IN LETTER A class-action complaint has been filed against a debt collector for allegedly violating the Fair Debt Collection Practices Act because of the language it used in a letter offering the plaintiff opportunities to repay the debt by making less than a payment in full.

Let's personalize your content