Troutman Pepper Weekly Consumer Financial Services Newsletter

Troutman Sanders

OCTOBER 30, 2023

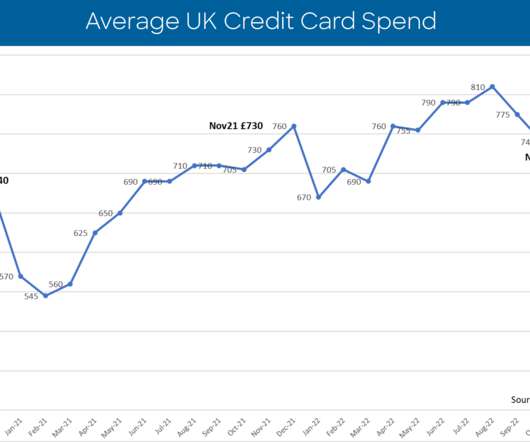

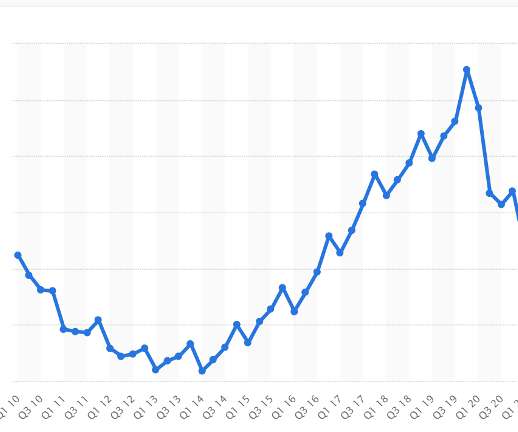

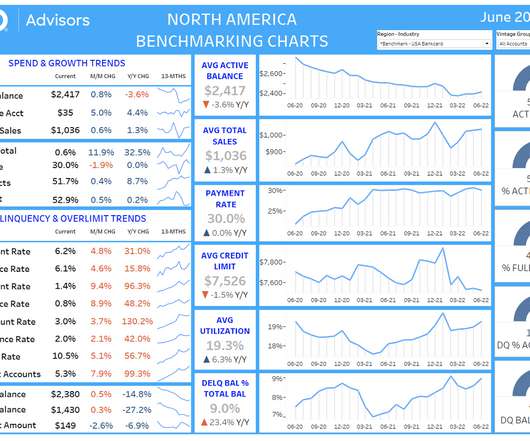

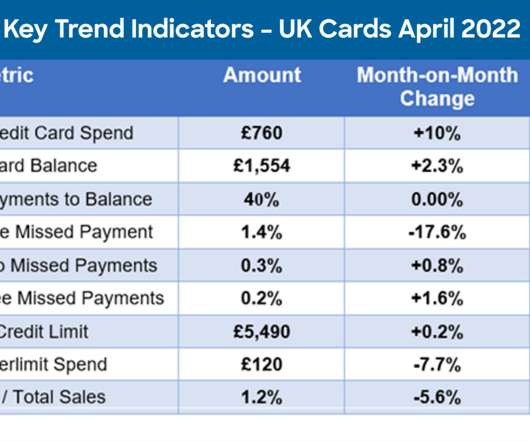

On October 26, a House Financial Services subcommittee drafted legislative proposals related to the buy now, pay later (BNPL) and earned wage access (EWA) market. On October 25, the CFPB released its biennial report to Congress on the consumer credit card market. financial institutions.

Let's personalize your content