Addressing Portfolio Risk in Economic Uncertainty: Part 4 (2022)

Fico Collections

DECEMBER 8, 2022

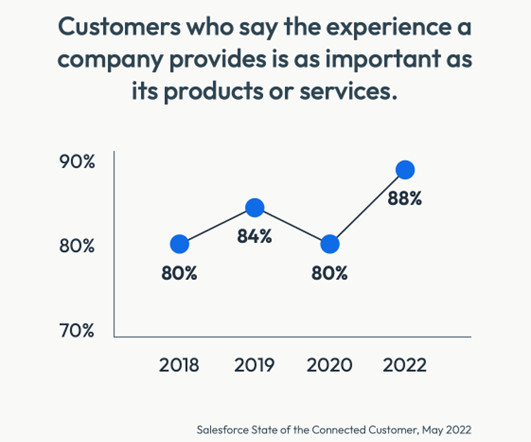

Building portfolio risk resilience into Collections & Recovery. Properly managed and strategized, the debt collections process can be an effective customer service asset and anti-attrition tool, in addition to being its classic role in portfolio risk management. Addressing Portfolio Risk in Economic Uncertainty: Part 4 (2022).

Let's personalize your content