CFPB Releases Blog Post Favoring Use of Self-Reported Cash Flow Data in Credit Underwriting

Troutman Sanders

JULY 28, 2023

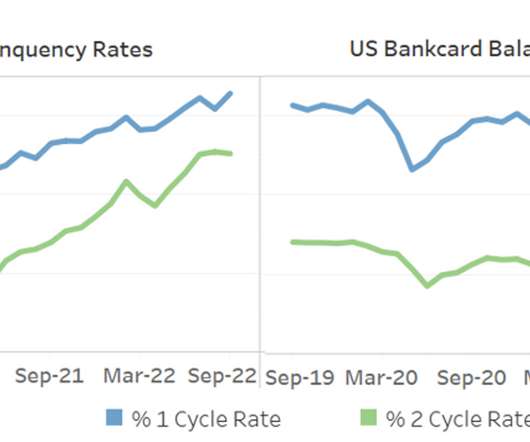

On July 27, the Consumer Financial Protection Bureau (CFPB) released a new blog post , positing that cashflow data, broadly defined as the various inflows, outflows, and accumulated amounts in a consumer’s checking and savings accounts, may provide lenders with a better picture of a consumer’s ability to repay their loans than using a credit score.

Let's personalize your content