Best Personal Loan Companies of 2022

Better Credit Blog

APRIL 1, 2022

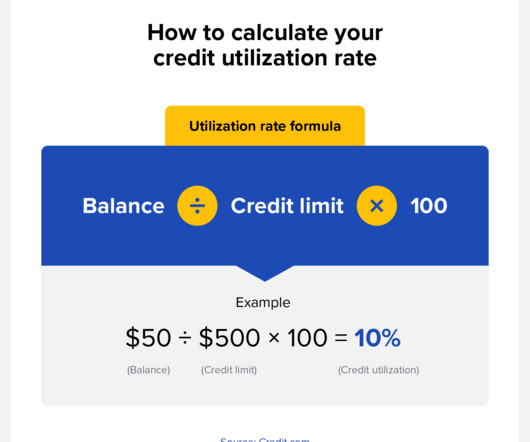

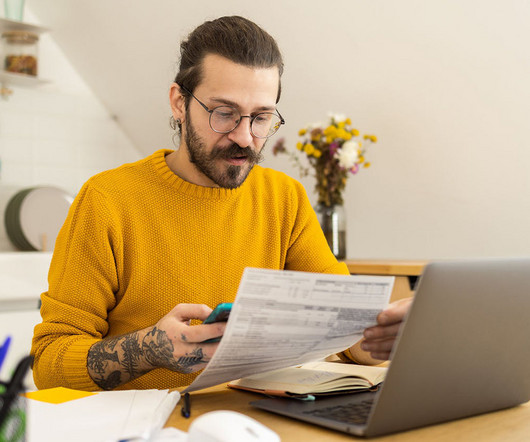

The best personal loans charge low fees and low fixed interest rates, have flexible loan amounts and terms, and have no prepayment penalties. A personal loan could let you access cash for any purpose. Since personal loans are unsecured, you’ll need an excellent credit score to get the best deal.

Let's personalize your content