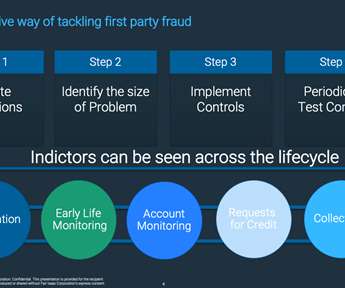

REDUCE BAD DEBT USING CREDIT APPLICATION FORMS

Debt Recoveries

JUNE 30, 2021

A good way to reduce bad debts is having great systems in place at the beginning. One of the best tools you can have is a credit application form. Basically, this is a request, usually in writing, for an extension of credit. Amount of credit extended. Cost of the credit (i.e.

Let's personalize your content