Will a Loan Modification Stop Foreclosure?

Sawin & Shea

FEBRUARY 28, 2023

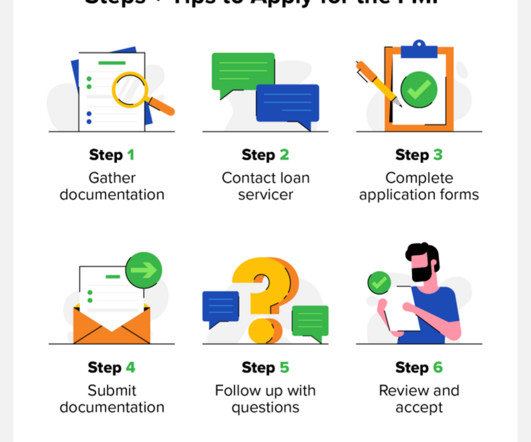

There are few life events as stressful as a foreclosure. However, there are ways to prevent foreclosure, even if you can’t afford your mortgage payments. One of those methods is through a loan modification. What is foreclosure? Your lender will then notify you that you are in default and begin foreclosure proceedings.

Let's personalize your content