The Lenders Giving Borrowers Second Chance Loans

Credit Corp

DECEMBER 14, 2020

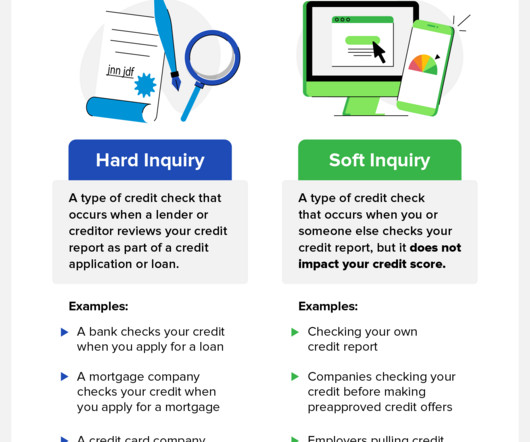

Sometimes it’s a foreclosure, increasingly often it’s due to large medical bills,” Pinsky notes. And unlike traditional loans, consumers with poor or slim credit histories may find that their creditworthiness gets judged in part by how they have handled utility bills or rent – transactions that usually don’t appear on credit reports.

Let's personalize your content