5 Ways to Transform Your Financial Strategy with QUALCO Data-Driven Decision Engine

Qualco

MAY 29, 2024

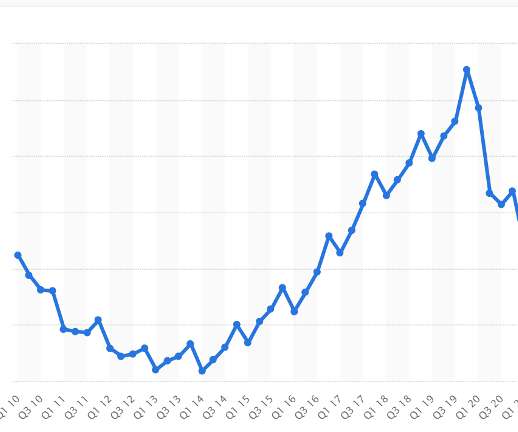

This presents challenges and opportunities for financial institutions , who must navigate the data-rich environment to maintain their competitive advantage in the market. By leveraging analytics, financial institutions can better understand customer behaviour , identify market trends, and manage risks effectively.

Let's personalize your content