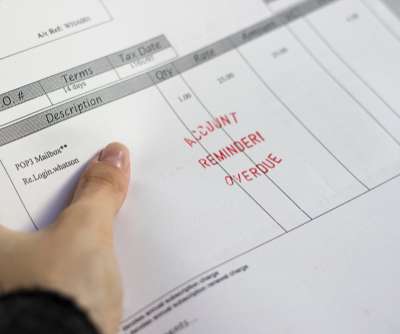

Judge Grants MSJ for Defendant in FDCPA Case Over Allegedly Fraudulent Loan

Account Recovery

APRIL 22, 2021

Claiming you have been the victim of identity theft is not enough to get a collection item removed from your credit report, a District Court judge in California has ruled, granting a defendant’s motion for summary judgment after the plaintiff claimed it violated the Fair Debt Collection Practices Act by continuing to report the debt … The (..)

Let's personalize your content