HMRC Debt Collection & Management: An Expert Guide

Hudson Weir

AUGUST 21, 2023

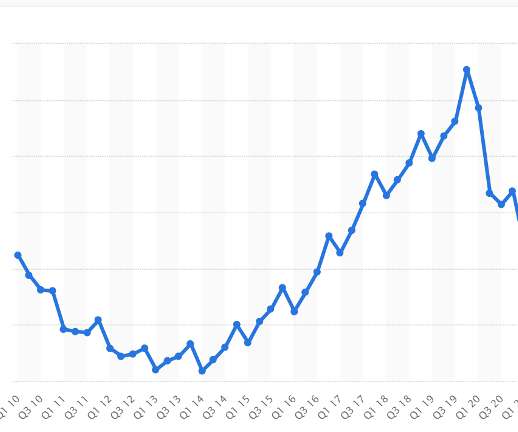

In this guide we explore HMRC debt management and collection, including the options if your business is struggling to make a repayment. The National Audit Office reports the total tax debt reached £42bn in September 2021, up from £16bn in January 2020 before COVID-19. If that’s the case, your company isn’t alone.

Let's personalize your content