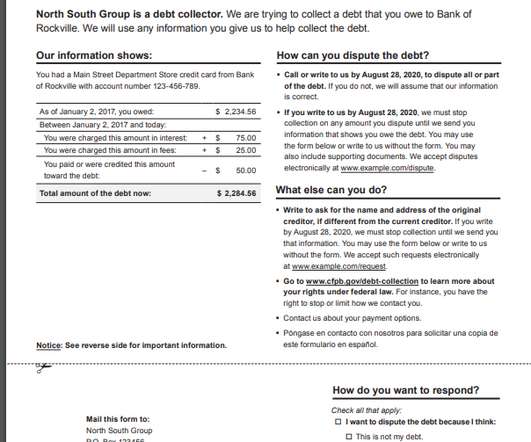

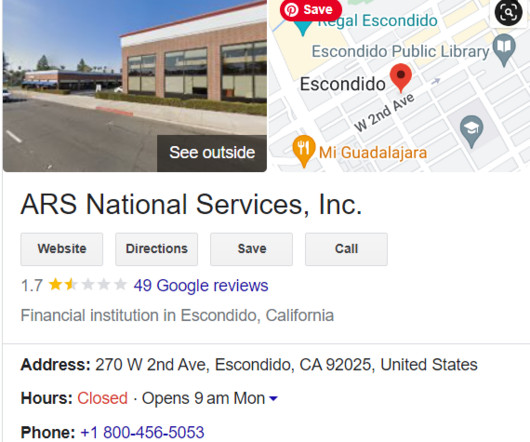

Daily Digest – December 2. Collector Accused of Violating Reg F Over Debt Parking; Data Breach at Wash. Collection Agency Impacts 3M Consumers

Account Recovery

DECEMBER 2, 2022

Collector Accused of Violating Reg F Over Debt Parking; Data Breach at Wash. Collection Agency Impacts 3M Consumers first appeared on AccountsRecovery.net. Collection Agency Impacts 3M Consumers first appeared on AccountsRecovery.net. The post Daily Digest – December 2.

Let's personalize your content