Credit Card Debt Is Making a Comeback

Nerd Wallet

NOVEMBER 15, 2022

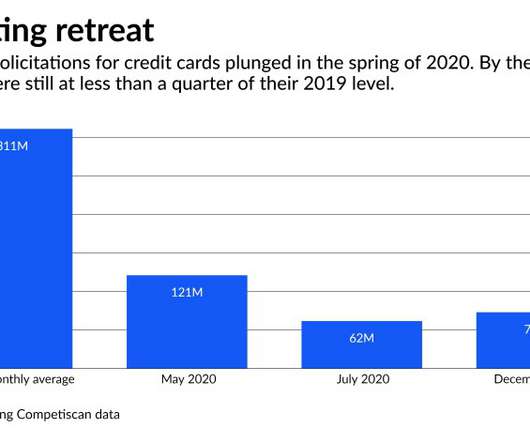

Credit card debt took a nosedive in the early days of the pandemic in 2020 as consumers stayed home, lost work and received cash infusions from the government. Credit card debt increased 15% year over year — the largest one-year increase in more than two decades, according to the Federal.

Let's personalize your content