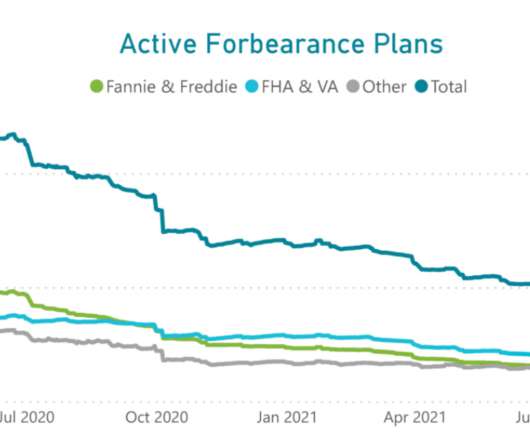

Tools for Addressing COVID-19 Mortgage Forbearance Balances

Debt Free Colorado

MARCH 1, 2022

Addressing COVID-19 Mortgage Forbearance Balances in Denver, CO. If you were in forbearance on your mortgage payments because of COVID-19, the time is quickly approaching for you to resume making payments and come up with a plan to get caught up on missed payments. Fannie Mae.

Let's personalize your content