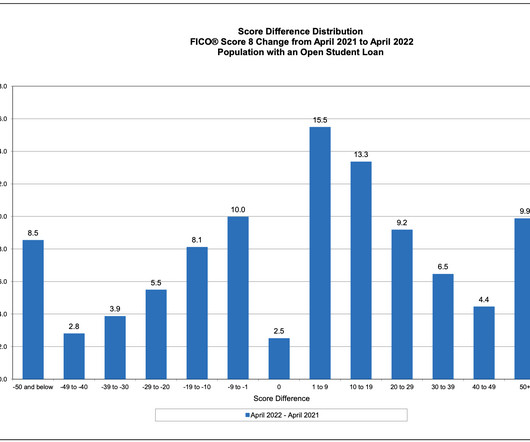

U.S. Student loan debt statistics you should know in 2023

Credit Corp

MARCH 21, 2023

million Americans have student loan debt, which totals over $1.7 If you owe tens of thousands of dollars in student loan debt, you’re not alone. According to the Federal Reserve’s Consumer Credit report, 43.5 million Americans have some form of federal or private student loan debt. 2021 37 10.2

Let's personalize your content