Household Debt Rose by $184 Billion in Q1 2024; Delinquency Transition Rates Increased Across All Debt Types

Collection Industry News

MAY 19, 2024

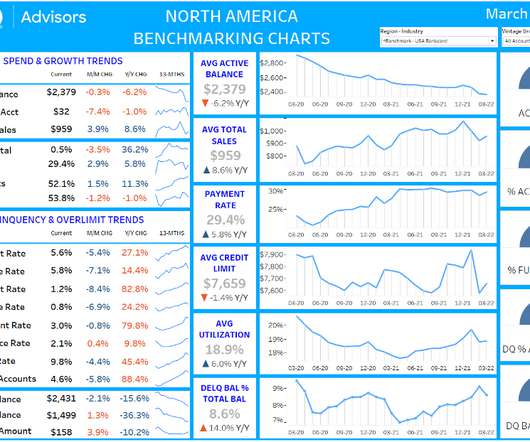

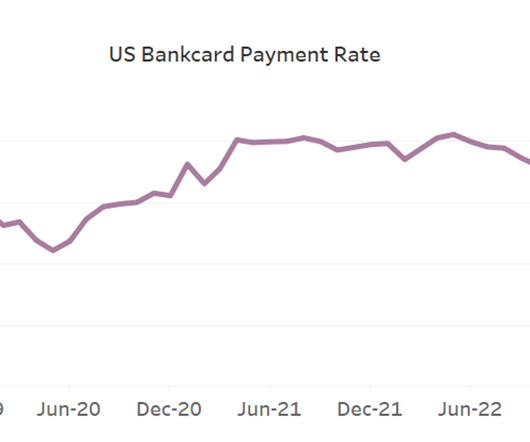

The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel. The New York Fed also issued an accompanying Liberty Street Economics blog post examining credit card utilization and its relationship with delinquency. Credit card balances decreased by $14 billion to $1.12

Let's personalize your content