Total Household Debt Reaches $17.06 Trillion in Q2 2023; Credit Card Debt Exceeds $1 Trillion

Collection Industry News

AUGUST 17, 2023

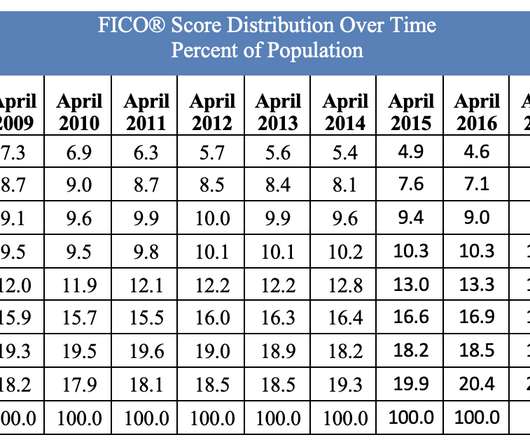

The report shows a slight uptick in total household debt in the second quarter of 2023, increasing by $16 billion (0.1%) to $17.06 The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel. Other balances, which include retail cards and other consumer loans, increased by $15 billion.

Let's personalize your content