US RMBS Loan Delinquencies Remain Stable; Foreclosures Edge Upward

Collection Industry News

JULY 18, 2022

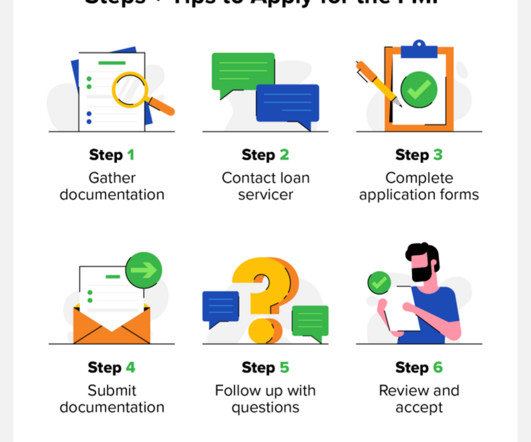

Fitch Ratings-New York-15 July 2022: Borrowers continue to work with their servicers post-forbearance to avoid loan default, according to Fitch Ratings’ 1Q22 U.S. The sole metric showing stress is in the foreclosure category, which rose marginally to 2% from 1% and to 3% from 2% for bank and non-bank servicers, respectively.

Let's personalize your content